The Low Advertised Rate Has a Catch

Mortgage Pricing- Why is that online rate so much lower?

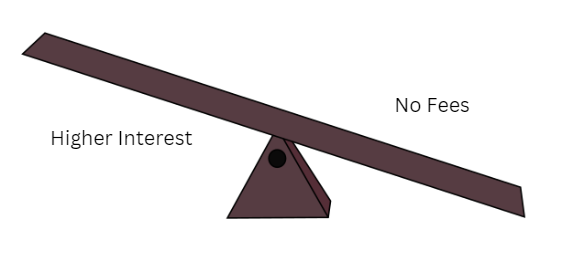

Glad you asked! Mortgage pricing has two components: your interest rate, which is the cost applied against the principal balance of your loan over the course of the term, and the cost to obtain that interest rate in fees, generally paid at closing. I find it is easiest to understand this by comparing the two extreme ends of the spectrum, if you consider it like a see-saw where as one goes up, the other goes down:

You could have a loan where no interest is charged, and the lender is compensated entirely in fees:

On one end, you can find special mortgages for certain religions where it is prohibited to pay interest. The mortgage will have 0 interest, but a very high fee which is frequently about the same in dollars as what you would have paid in interest over the course of the loan. What a coincidence!

Or you could have a loan where the lender has no fees and only is compensated in interest:

On the other end, some mortgage companies advertise “no closing costs” where the borrower does not pay for some portion of the closing costs for the mortgage. I can promise that the appraiser is not working for free, nor is the attorney who is performing the closing or the title insurance company that issues the insurance policy- there certainly still are those closing costs, but the lender covers them by offering a higher interest rate, and using the higher profit to pay for those services.

I typically default to pricing loans at a neutral scenario: we charge a lender fee that is slightly lower than what is typical in our market, and the rate I quote is usually as close as I can find to having neither a cost nor a credit. Then we can discuss for your specific scenario whether it makes sense to move in one direction or the other and pay to reduce the rate or go slightly higher in the rate to reduce your costs.

When I go to a certain website that has rates from banks and click “home purchase” the top two results are for an adjustable rate which we will filter out, and the top two results for lowest interest rate have 2.37% and 2.21% of the loan amount in costs respectively. While my neutral quote for that scenario would be higher in interest rate, if paying that much up front to buy down the rate makes sense for you, I can offer that same rate. Does it make sense for you to go with a loan scenario where you will need to keep the loan for 41 months for your interest savings to equal what it cost you to get that rate- probably not, but that’s another conversation for another day.

Screenshot of a lead aggregator site with the top results- low rates, but at huge costs!

Would I probably have more inquiries if I advertised super low rates without educating my clients on the cost for that rate? Absolutely. There’s a reason why the big lenders with expensive advertising campaigns almost universally have fees included in their advertised rates, but I personally find it to be unhelpful at best and deceptive at worst. I’d rather lose some business than spend all day telling people the terms they thought they were getting aren’t actually what the fine print said.